$10 Billion and Counting: Why Fusion Energy Is Becoming the Hottest Bet in Clean Power

Fusion energy is no longer just a laboratory experiment. In the past four years, it has attracted nearly $10 billion in private investment, including a record $2.64 billion in the past 12 months—a 178% surge from the previous year. This momentum signals a critical shift: fusion has moved from a distant dream to a commercially viable contender in the global energy market.

Why the acceleration? The answer lies at the intersection of two powerful forces: the urgent need for clean, carbon-free power and the soaring energy demand from AI and data centers, which require 24/7 electricity that renewables alone can’t fully supply. At the same time, technological breakthroughs have given investors confidence that fusion is no longer just a scientific pursuit—it’s an emerging industry.

Unprecedented Growth, Unprecedented Opportunity

The numbers behind fusion’s rise are striking. In the year leading up to July 2025, the sector secured $2.64 billion in private capital, driving total cumulative investment to $9.766 billion across 53 companies. That’s five times higher than in 2021.

But here’s the challenge: building the first generation of commercial pilot plants will require an estimated $77 billion, underlining the scale of opportunity—and the immense capital intensity—of this transition.

A Global Race for Fusion Leadership

While U.S. companies currently dominate private investment, the race is global. China and Germany are stepping up with ambitious, state-backed strategies:

China launched China Fusion Energy Co. Ltd with $2.1 billion in capital and saw its startup NovaFusionX raise $69.4 million in angel funding—the largest of its kind in the country.

Germany is backing innovators like Proxima Fusion and Marvel Fusion under its High-Tech Agenda and the upcoming Action Plan Fusion, signaling long-term commitment to building a domestic fusion ecosystem.

Meanwhile, in the U.S., tech giants are sending strong signals of confidence through pioneering Power Purchase Agreements (PPAs):

Microsoft partnered with Helion Energy to deliver 50MW of fusion power by 2028.

Google committed to 200MW from Commonwealth Fusion Systems (CFS), with options for future expansion.

These PPAs aren’t just contracts—they’re market-defining moves that give developers financial stability and attract further investment.

Why Now? The Forces Behind the Surge

Three main drivers are powering this investment boom:

Decarbonization Goals: Fusion offers firm, carbon-free power—critical for meeting net-zero targets.

Digital Infrastructure Growth: AI and data centers could multiply energy demand 30-fold by 2035, creating an urgent need for reliable, high-density electricity.

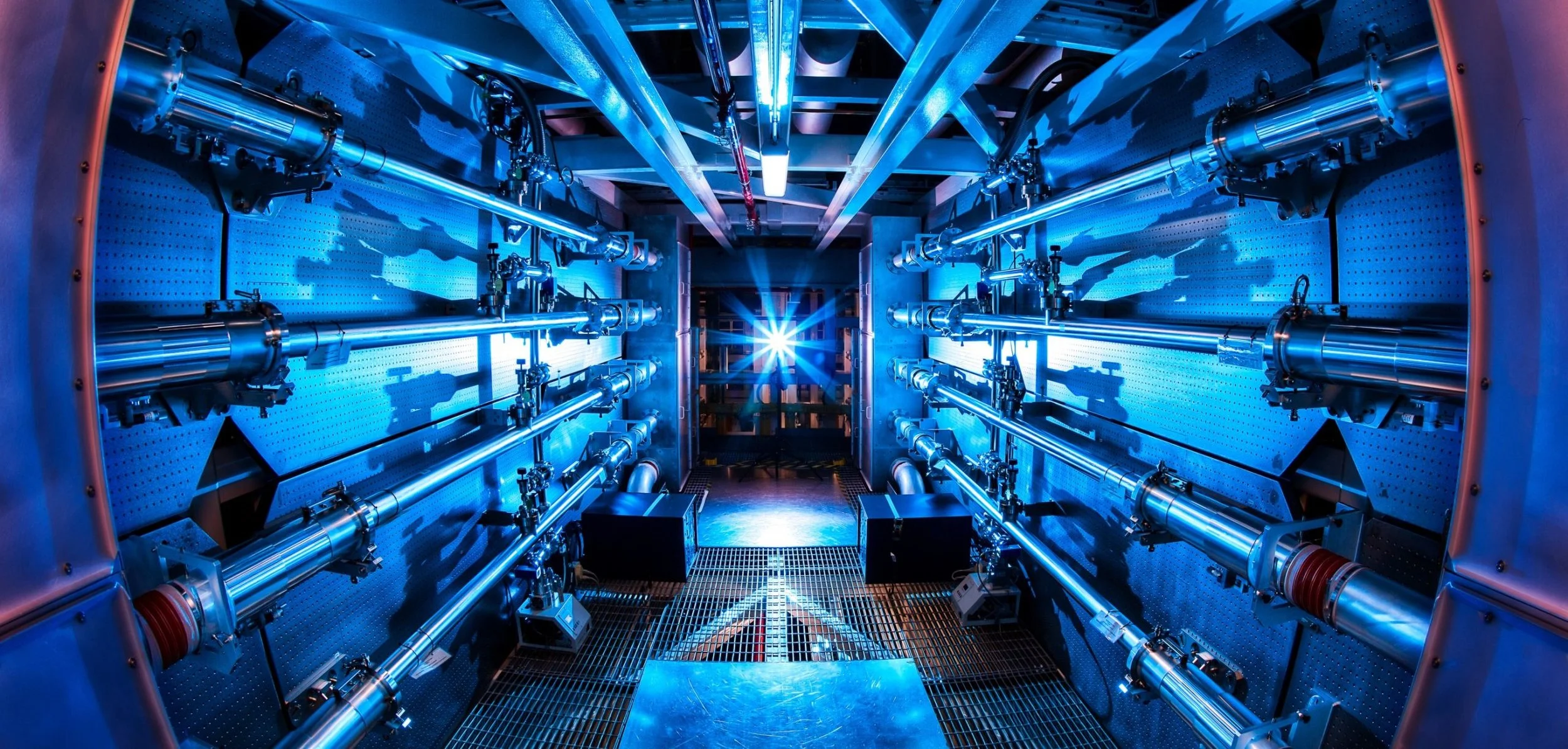

Technological Progress: Breakthroughs like high-temperature superconducting magnets and Helion’s achievement of 100 million°C plasma have turned fusion from theory into near-term reality.

Challenges on the Horizon

For all the optimism, the road ahead is complex. The industry faces:

Massive capital requirements, likely driving consolidation.

Supply chain bottlenecks, especially for advanced magnets and materials.

Talent shortages, as workforce demand outpaces current training pipelines.

Regulatory gaps, since traditional nuclear rules don’t fit fusion’s unique characteristics.

Without clear regulatory frameworks and stronger supply chains, progress could stall.

The Outlook: A 2030s Reality

Despite these challenges, confidence remains high. 84% of fusion companies expect to deliver power to the grid before 2040, with most aiming for the early 2030s. Achieving that will require:

Strategic partnerships between governments, developers, and industry.

Sustained investment and policy support.

A coordinated push to build talent pipelines and supply chain resilience.

Fusion is no longer a distant hope; it’s shaping up to be a cornerstone of the future energy ecosystem.