India As Next Fusion Powerhouse? Top Fusion Startups to Watch in 2025

As the global fusion race shifts from research to engineering, India’s scientific legacy, digital capability, and emerging deep-tech ecosystem are quietly positioning the country for a leading role in the energy transition decade.

A Global Shift: Fusion Moves from Theory to Industry

By 2025, fusion energy is no longer confined to research labs — it’s rapidly evolving into a commercial engineering race.

Around the world, fusion innovators are proving that clean, limitless energy may soon move from experiment to enterprise:

Helion Energy (US) is building Orion, the world’s first privately funded fusion plant, backed by Microsoft’s 50 MW power purchase deal.

Commonwealth Fusion Systems (US) is completing SPARC, expected to achieve net energy gain by 2027.

Tokamak Energy (UK) and TAE Technologies (US) are advancing compact magnet and plasma systems designed for commercial deployment.

Global private fusion investment has now exceeded USD 8 billion, backed by Chevron, Nvidia, and Breakthrough Energy Ventures. The question is no longer if fusion will work — but how fast it can scale.

India’s Quiet Strength in Fusion

While the US, UK, and Japan dominate headlines, India’s contribution to the global fusion effort has been consistent and strategic.

Through its long-standing involvement in the ITER project in France, India has built capabilities that few nations outside the G7 can claim:

Engineering excellence: L&T fabricated the 3,850-tonne ITER Cryostat, the world’s largest stainless-steel vacuum chamber.

Precision manufacturing: Godrej & Boyce, Engineers India, and Tata Consulting Engineers supplied critical components and subsystems.

Research depth: The Institute for Plasma Research (IPR) continues to operate two functioning tokamaks and advance plasma diagnostics.

This network of public institutions and private engineering firms has created a fusion-ready industrial base, making India a quiet but serious player in the global energy transformation.

Institutional Foundation: From National Program to Global Partner

India’s national fusion journey began under the Department of Atomic Energy (DAE), leading to the establishment of the Institute for Plasma Research (IPR) in Gandhinagar.

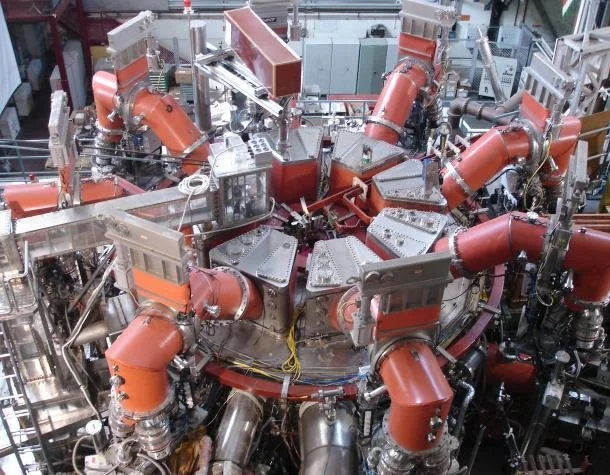

IPR’s devices — ADITYA-U Tokamak and SST-1 (Steady State Superconducting Tokamak) — represent decades of learning in plasma control, magnetic confinement, and reactor design.

Top view of SST-1 (Steady State Superconducting Tokamak) machine at the Institute for Plasma Research, Gujarat — India’s experimental fusion device for plasma confinement studies.

These achievements have given India three strategic advantages:

Technical maturity — ability to design and operate complete fusion-class systems.

Industrial readiness — supply chains capable of delivering nuclear-grade precision.

Global credibility — proven performance as an ITER contributor.

This combination positions India to move from research collaborator to strategic enabler in the emerging global fusion ecosystem.

The Talent Engine: Building India’s Fusion Workforce

Fusion requires a rare blend of skills — physics, data, and industrial design. India’s institutions are already investing in this mix.

IITs, IISc, and BARC are training experts in materials science, cryogenics, plasma modeling, and digital control.

At IISc Bengaluru, researchers use AI-driven plasma modeling to predict and stabilize fusion reactions.

The GaN Ecosystem Enabling Centre (GEECI) develops advanced power electronics critical for high-frequency reactor systems.

This integrated network of universities, research centers, and industry programs ensures India has the human capital needed to participate meaningfully in global fusion development.

Public Science to Private Innovation

India’s fusion momentum is no longer confined to national labs. A growing bridge now connects public R&D with private enterprise. Under NITI Aayog’s Atal Innovation Mission, the AIC-IPR Plasmatech Innovation Foundation was launched in 2023 within IPR Gandhinagar.

This initiative:

Provides startups access to IPR’s labs and scientific mentors.

Supports commercialization of DAE-developed plasma and materials technologies.

Operates under a Government-Owned, Company-Operated (GOCO) model — a first in Indian clean-tech incubation.

It marks a critical shift from state-led research to market-oriented innovation, translating decades of scientific investment into industrial opportunity.

Where AI and Fusion Converge

In the race to commercialize fusion, software is becoming as important as hardware — and this is where India’s digital edge shines.

Modern reactors depend on real-time AI control systems that can stabilize plasma faster than human operators.

India’s semiconductor and AI sectors are already building that expertise.

Maieutic Semiconductor (Bengaluru) raised USD 4.15 million to develop an AI-driven analog chip design platform, cutting design cycles from weeks to days.

These chips enable ultra-fast sensor and power control in fusion systems.

IISc’s GEECI program is advancing Gallium Nitride (GaN) components — smaller, more efficient alternatives to silicon electronics used in RF heating and diagnostics.

Together, these developments give India a lower-capital, technology-driven entry point into the global fusion supply chain, beyond large-scale reactor construction.

India’s Industrial Backbone: Ready for Fusion

India’s deep industrial ecosystem — built for nuclear, aerospace, and defense — already aligns with the precision needs of fusion.

Key players include:

CORE Energy Systems (Mumbai): Raised INR 2 billion (USD 22.8 million) and licensed U.S. technology to locally manufacture Primary Coolant Pumps, a vital fusion and nuclear system component.

Larsen & Toubro (L&T): India’s premier EPC company, responsible for complex ITER components and poised to lead domestic fusion infrastructure projects.

These firms represent the anchor layer of India’s private fusion future — providing the manufacturing credibility and quality assurance required for commercial reactors.

Fusion Startups to Watch

India’s first wave of fusion-focused and fusion-adjacent startups is emerging, backed by early-stage investors and academic collaboration.

Pranos Fusion (Bengaluru) – Compact spherical tokamaks for distributed clean energy; raised USD 417k (Industrial47, Startup India).

Anubal Fusion (Gurugram) – Developing laser-based confinement systems; secured USD 294k from Speciale Invest.

Agni Fusion Energy – Targeting localized tokamak designs adapted to Asia-Pacific energy needs.

HYLERN Technologies (Raipur) – Building low-energy nuclear heat systems; raised USD 3 million pre-Series A (Valour Capital, CIL).

EX-Fusion (Japan) – Opened an R&D center in Bengaluru, collaborating with Indian suppliers and researchers.

🔹 These ventures represent the early signals of India’s fusion commercialization era — diverse, data-driven, and globally networked.

Capital and Policy: The Missing Link

Despite strong institutional and industrial foundations, India’s fusion ecosystem faces two structural challenges:

1. Capital availability

Typical Indian fusion startups raise under USD 5 million, well below the global prototype average of USD 1–3 billion.

Institutional investors remain cautious due to long project timelines and regulatory ambiguity.

2. Policy alignment

India’s current Atomic Energy framework limits private sector participation in fusion-related activities.

Modernizing these rules and aligning with global nuclear standards would attract foreign investment and joint ventures.

Government signals are positive — such as the ₹20,000 crore Nuclear Energy Mission (2025–26) — but practical implementation will determine whether fusion can scale beyond research.

India’s Fusion Outlook: The 2035 Horizon

India’s fusion pathway can be viewed in three key phases:

2025–2030:

Policy adjustments and incubation of fusion-adjacent startups.

Growth in AI-driven control and materials innovation.

2030–2035:

Deeper integration with international demonstration projects.

Early prototypes leveraging public-private partnerships.

Post-2035:

Indigenous DEMO-class systems.

India as a global supplier of fusion components, diagnostics, and control technology.

If executed strategically, India could transition from a contributor to a co-leader in the global fusion supply chain.

From Strength to Leadership

India’s fusion opportunity lies not in replicating Western programs, but in leveraging its own strengths — world-class engineering, digital talent, and a maturing innovation ecosystem.

By aligning policy, private investment, and industrial expertise, India can accelerate its entry into the fusion decade — not as a latecomer, but as an early enabler. Fusion may be the energy of the future. India’s challenge — and opportunity — is to make that future arrive sooner.