Is Asia-Pacific Shaping the Next Chapter of Fusion Energy?

For decades, the pursuit of fusion energy has been primarily associated with large-scale Western-led initiatives. Today, a strategic shift is unfolding as the Asia-Pacific (APAC) region emerges as a key player in shaping the next phase of global fusion development. From China’s record-setting reactor performance to Japan’s compact design innovation, and from South Korea’s steady experimental success to India’s scalable manufacturing potential—APAC is actively influencing the trajectory of fusion energy.

A Rising Arc of Investment and Innovation

Global investment in fusion has exceeded $7.1 billion in private funding, but it is the APAC region that is projected to be the fastest-growing market from 2025 to 2034. This growth is underpinned by significant government backing, clear national roadmaps, and alignment with broader clean energy and industrial strategies.

China: Leading with Scale and Strategy

China invests more in clean energy than any other nation, with approximately one-third of global energy investment originating there. In 2023 alone, fusion R&D spending reached $1.5 billion. The EAST tokamak has repeatedly broken records in plasma temperature and duration, while the recent unveiling of the HH70—the world’s first high-temperature superconductor (HTS) tokamak—marks a major leap toward scalable, economically viable fusion. China’s integrated approach—combining government direction, state-owned enterprises, and a growing private sector—creates an ecosystem that enables long-term fusion development insulated from market volatility.

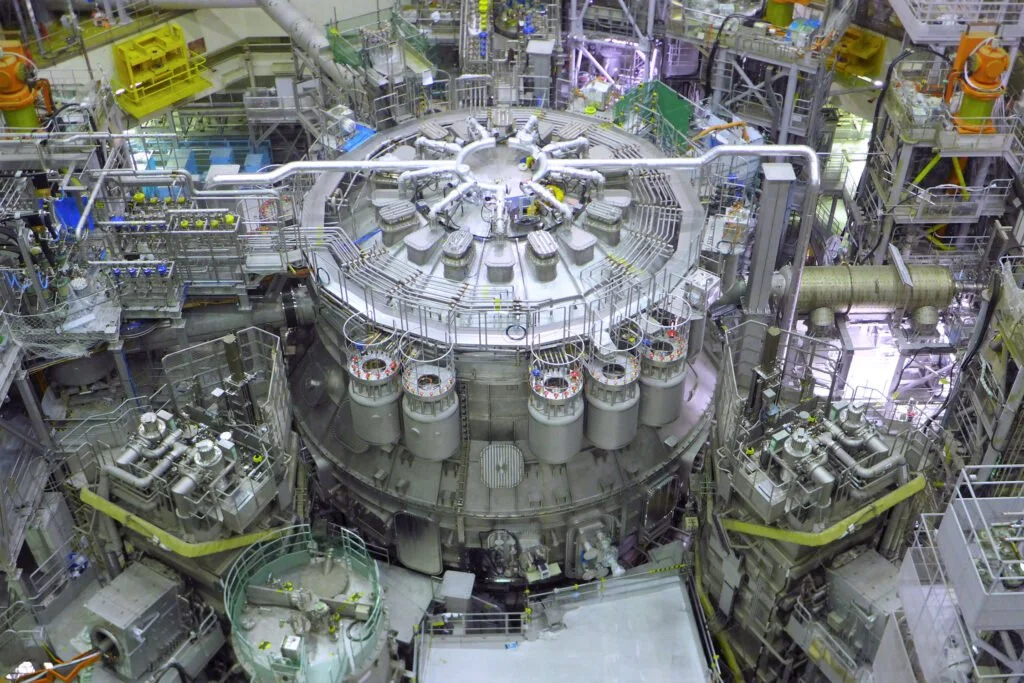

Japan: Precision Engineering and Compact Innovation

Japan's strength lies in precision and materials expertise. As a major contributor to ITER, it provides critical components such as superconducting coils and diagnostics. The launch of the FAST (Fusion by Advanced Superconducting Tokamak) project in 2024 signals Japan’s focus on compact, efficient reactors. Additionally, startups like Kyoto Fusioneering and EX-Fusion are pioneering technologies in tritium fuel cycles and laser ignition systems, reinforcing Japan’s role in specialized, high-value fusion development.

South Korea: Consistency and Collaboration

South Korea’s KSTAR tokamak has achieved world-class plasma performance, maintaining high temperatures for extended periods. The national roadmap aims to commercialize fusion by 2040, supported by significant investments in workforce development and industrial readiness. South Korea also plays a vital role in international collaboration, working closely with ITER, European partners, and U.S. laboratories.

India: Manufacturing at Scale

India’s participation in ITER includes delivering 9% of all hardware, including the massive cryostat built by L&T. Its comparative advantage lies in cost-effective, high-quality manufacturing of complex components. Emerging private players like Pranos are gaining visibility, pointing to a growing innovation ecosystem. India’s industrial capacity positions it as a valuable partner for global fusion supply chains.

This video, This Bengaluru startup is leading India's nuclear fusion research: Meet the founders of 'Pranos', is relevant as it directly highlights a new private player in India's fusion energy landscape, reinforcing the point about India's growing innovation ecosystem.

Strategic Signals for Global Stakeholders

The APAC region’s momentum reflects several core strengths that are critical to accelerating fusion energy globally:

Policy-Driven Investment: Long-term, state-backed funding creates resilience and supports sustained R&D.

STEM Talent Depth: The region graduates millions of STEM professionals annually, building a robust pipeline for fusion expertise.

Manufacturing Ecosystems: Japan, South Korea, and India are already integrated into global high-tech supply chains—an advantage as fusion scales from lab to grid.

The Broader Implication: Collaboration, Not Competition

Asia-Pacific’s growing leadership in fusion should be viewed not as a threat, but as a complementary force to Western innovation. Fusion will benefit most from a globally collaborative model that combines APAC’s strengths in speed, scale, and industrialization with the West’s strengths in scientific research and IP generation. However, challenges remain. Transparency, especially in Chinese research, intellectual property protection, and export controls on dual-use technologies require careful navigation. Building common standards and trust mechanisms will be essential for enabling cross-border projects and integrated supply chains.

Watching the Dynamic Transformation

As fusion moves from theory to infrastructure, Asia-Pacific is shaping its future direction. Stakeholders across clean energy, policy, and finance would do well to follow this transformation closely not only to understand the regional dynamics but to identify where opportunity, influence, and partnership potential are emerging next. Fusion energy is no longer a Western-led promise, it is becoming a multi-polar, cross-continental pursuit. And APAC is clearly helping to write its next chapter.