Fueling Fusion Reactors: The Real Constraint in 2026

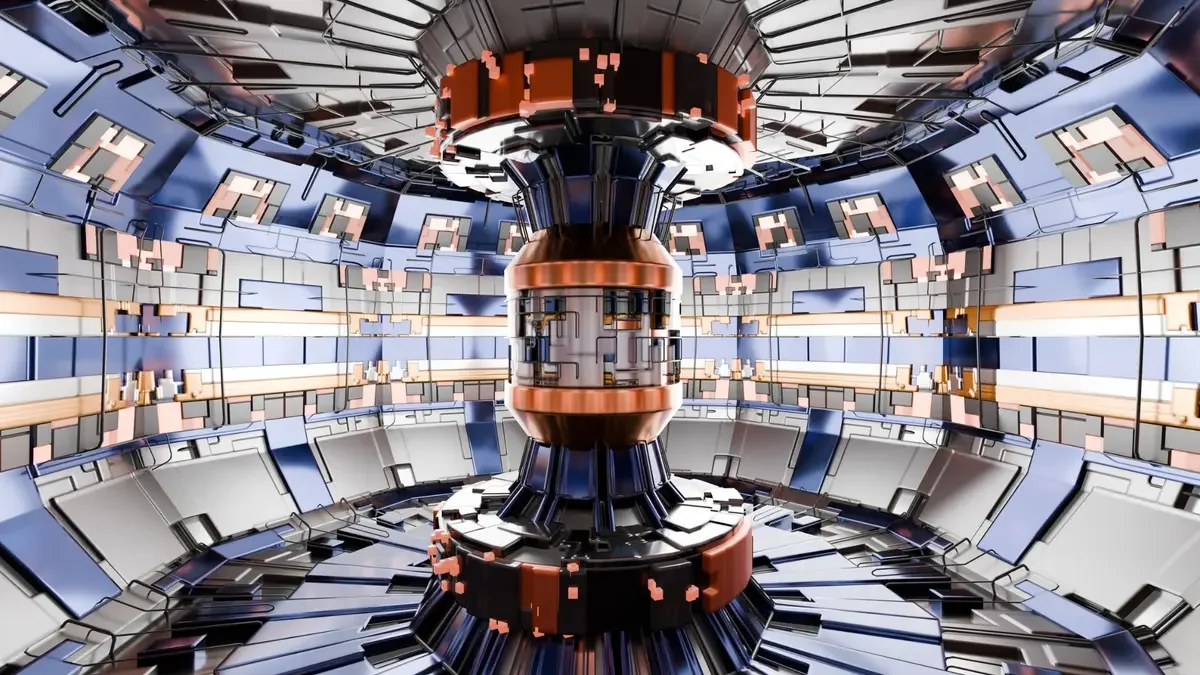

In early 2026, the global fusion energy sector crossed a historic threshold. The strategic conversation among investors, governments, and industry leaders has fundamentally shifted: the question is no longer simply how to achieve fusion, but rather how to fuel it. As cumulative private investment approaches 15.17 billion USD, the market focus has pivoted from laboratory breakthroughs to the industrial stack—the critical supply chain of materials, regulatory frameworks, and components that will determine which reactor designs are truly bankable.

The Tritium Inventory Crisis

The most immediate challenge for the incumbent Deuterium-Tritium pathway is the severe scarcity of tritium. This radioactive isotope is exceptionally rare in nature, and as of 2026 global market tracking, the civilian stockpile remains at a critical threshold of just 20 to 30 kilograms.

The inventory gap facing the industry is stark:

Tritium is a decaying asset that loses approximately 5.5 percent of its mass annually.

Based on industrial consumption models, a single 1 gigawatt commercial fusion reactor requires approximately 55 kilograms of tritium per year to operate.

Without internal breeding, the entire global civilian reserve would be exhausted by such a plant in less than six months.

According to 2025–2026 commercial disclosures from isotope suppliers, market values have stabilized between 30,000 and 35,000 USD per gram, positioning tritium as one of the most expensive industrial materials on Earth.

For commercial viability, reactors must move beyond external supplies and achieve breeding readiness to generate their own fuel within the reactor itself.

Lithium-6 and Strategic Isotope Autonomy

The secondary bottleneck is Lithium-6, the essential feedstock for the breeding blankets that produce tritium. Natural lithium contains only 7.5 percent of this isotope, yet high-efficiency breeding blankets require enrichment levels between 30 percent and 90 percent.

Historically, global production of enriched Lithium-6 has been concentrated in Russia and China, creating a profound sovereignty risk. In response, Strategic Isotope Autonomy has emerged as a central pillar of energy policy. The Paducah Laser Enrichment Facility, utilizing technology that reached technology readiness level 6 in late 2025, now serves as a strategic anchor for domestic Lithium-6 production in North America.

The Aneutronic Alternative: The Rise of Helium-3

The scarcity of terrestrial isotopes has accelerated interest in Helium-3 fusion, which offers a cleaner, aneutronic alternative. While large-scale commercial lunar mining is realistically a post-2035 horizon, the 2026 market is already defining the infrastructure for this non-terrestrial resource.

Interlune is currently testing a technology readiness level 6 prototype lunar excavator and has secured over 300 million USD in contracts for deliveries starting in 2029.

Lunar Helium-3 Mining (LH3M) has established a leadership position by securing multiple architecture patents for lunar operations.

Bluefors has committed to purchasing 10,000 liters of Helium-3 annually to power the next phase of quantum industry growth.

Global Licensing and Regulatory Pathways

Investors are increasingly prioritizing the licensing and safety pathways that govern deployment. While the U.S. Nuclear Regulatory Commission has established a risk-informed framework, this is part of a broader international movement toward specialized fusion licensing.

United Kingdom: The STEP (Spherical Tokamak for Energy Production) program has entered its scale-up phase, targeting a prototype power plant at West Burton by 2040.

European Union: EUROfusion has transitioned into the conceptual design phase for DEMO, the successor to ITER, which aims to demonstrate net electricity production and a closed fuel cycle.

Japan: The JT-60SA superconducting fusion system serves as a vital bridge toward commercial prototypes and ITER-adjacent research, providing critical data for the next generation of magnetic confinement devices.

The AI-Fusion Nexus and Market Parity

This industrial race is accelerating due to the rapid expansion of generative artificial intelligence. In fusion, the first customers are not traditional utilities—they are compute. Tech hyperscalers are no longer just funding research; they are acting as the anchor tenants for the first generation of fusion plants.

The first fusion Power Purchase Agreements (PPAs) are projected for 2032–2038 at premium baseload pricing, with hyperscalers absorbing early capacity for reliability rather than immediate cost parity with natural gas. By 2026, energy availability has become the primary site selection criterion for data centers, turning fusion fuel into a mission-critical technology commodity.

Engineering Validation and the Road to 2030

The year 2026 marks the transition from theoretical designs to integrated industrial testing. Key benchmarks now define the landscape for capital deployment:

A plant must demonstrate a tritium breeding ratio greater than 1.05 to account for decay and processing losses.

The BABY experiment at MIT has provided the first physical measurements of breeding ratios in molten salts, aligning simulation models with physical reality.

The commissioning of the UNITY-2 facility in late 2026 represents the world’s first non-nuclear integrated test of a closed-loop fuel cycle.

As the industry scales, the competitive moat has shifted from the plasma to the pipes. The most resilient market players are those pursuing vertical integration to hedge against supply chain volatility, ensuring they can thrive in a future powered by sustainable, zero-carbon energy.