Fusion Industry Investment Trends 2026: Where the Money Is Going

In 2025, investment in the fusion energy industry surged dramatically. By the end of the year, cumulative investment crossed the $15 billion milestone. This sharp rise reflects not just deepening investment from traditional science budgets, but an increasingly diverse capital base, including venture funds, corporate strategic partners, and the non-energy sector. What was once almost entirely funded by government research programs is now attracting a blend of public and private funding as fusion edges closer to commercial relevance.

The fusion industry capital ecosystem in 2026 remains anchored by deep-tech venture capital, energy giants, and sovereign wealth funds. This diversification brings both capital and strategic expertise—helping companies build supply chains, navigate regulatory environments, and prepare for eventual commercial deployment.

Technological Collaboration

In early 2026, the most visible trend is the partnership between fusion companies and technology powerhouses. Fusion energy has moved to build its infrastructure using AI and digital engineering to improve performance.

For example, Commonwealth Fusion Systems (CFS) recently announced a landmark collaboration with NVIDIA and Siemens to develop a "digital twin" of its SPARC fusion machine. By using AI-powered physics models and industrial software, CFS aims to compress years of manual experimentation into weeks of virtual optimization. This shift toward "digital fusion" allows companies to bridge the gap between plasma physics and industrial readiness, a model we expect to see adopted across the industry this year.

Infrastructure Investment

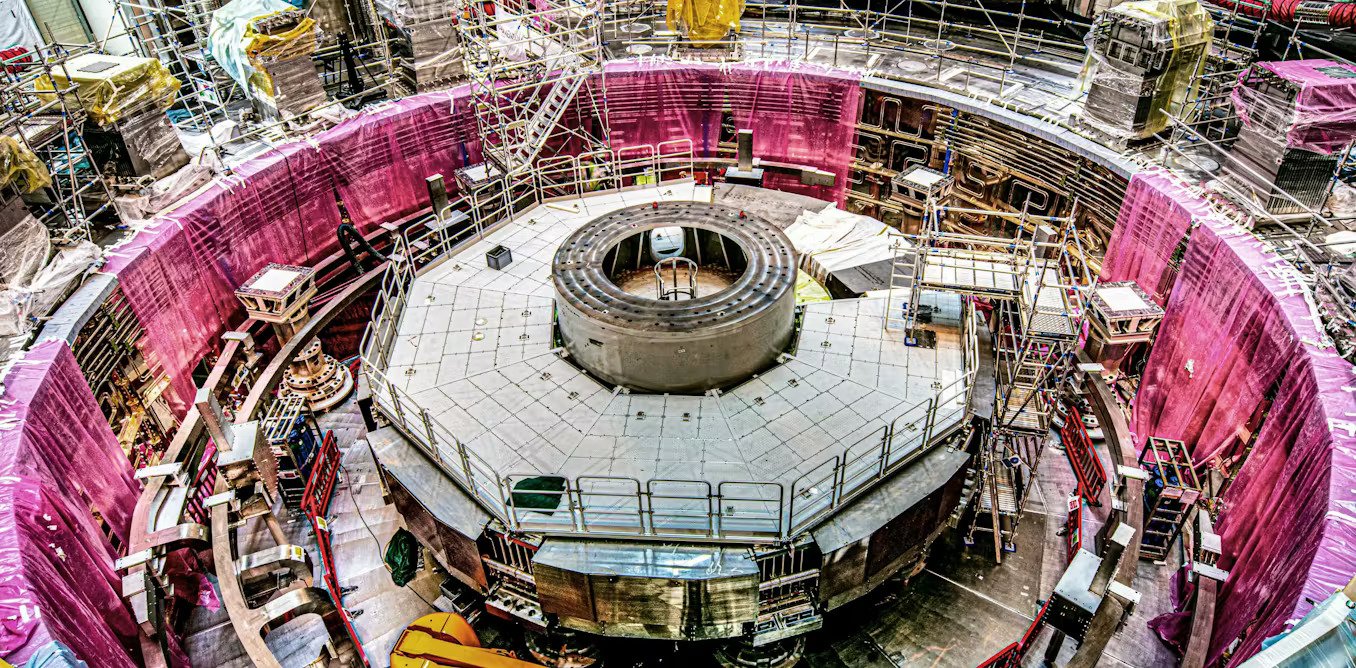

Fusion is reaching its industrial phase. Commercialization requires significant physical infrastructure beyond individual reactors. These large-scale projects, such as specialized testbeds and shared tritium processing facilities, help lower the system-wide risk of deployment. In 2026, we are seeing a shift toward "Site-as-a-Service" models, where companies like Type One Energy and Helion are investing in specific geographic hubs to accommodate the fusion timeline targeting the early 2030s.

Seed & Early Stage Investment

Fusion is becoming mainstream and anticipated by many. Multiple start-up raise raised significant rounds in 2025 and it’s going to happen again in 2026. Seed and early-stage finance continues to build the innovation pipeline, enabling emerging technologies and novel engineering solutions to reach higher maturity. Investors are backing a broad mix of fusion approaches reflecting a belief that multiple technical pathways may find commercial success.

Supply Chains

The development of a robust supply chain is the backbone of the industry. Spending on fusion supply chains rose to $543 million by the start of 2026. Suppliers report increased business with fusion companies as projects hit milestones requiring high-temperature superconducting (HTS) magnets, precision vacuum vessels, and advanced power electronics. However, 81% of suppliers still cite "lack of certainty" as a barrier to scaling, making long-term purchase agreements (like Eni’s $1 billion power purchase agreement with CFS) critical for market stability.

Workforce and Human Capital

Growth in fusion companies parallels hiring across engineering, plasma physics, and industrial systems. As supply chains mature, workforce development has become a strategic priority. Investment in this field will bring specialized training programs and university partnerships designed to bridge the "talent gap." By 2026, direct employment in the private fusion sector is estimated to have surpassed 5,000 people, supporting an additional 10,000+ jobs in the secondary supply chain.

Investment in the fusion industry in 2026 is multi-layered. This diversified flow reflects how fusion energy continues its transition from pure scientific research toward industrial relevance. Record levels of funding and broader investor participation have set the stage for 2026, where capital deployment is increasingly strategic.

With technology collaborations, public-private infrastructure buildout, strong early-stage financing, and expanding supply chains, fusion investment trends in 2026 reveal a sector that is steadily laying the foundation for a future clean.