Fusion Energy Lens: 2025 Year of Industrial Transition

Strategic Decoupling, AI Convergence, and the Transition to Global Deployment

After decades of anticipation, 2025 finally turns the promise of nuclear fusion into measurable industrial reality. The long-standing narrative of fusion as a 'perpetually distant' technology has been replaced by a precise engineering timeline, driven by the urgent energy demands of the AI revolution and a global mandate for carbon-neutral baseload power. This wrap-up highlights the key milestones, market developments, and strategic shifts that defined Fusion Energy in 2025.

The Rise of Regional Fusion Hubs

North America – The “Venture-Led Corridor”

Anchored by Helion Energy and Zap Energy, the Pacific Northwest has emerged as a leader in commercial siting. In late 2025, Helion secured a landmark permit for its "Orion" facility in Washington, demonstrating that fusion can meet rigorous industrial standards on commercial brownfields.

Key 2025 Takeaway: Helion’s successful permitting sets the global precedent for moving fusion from specialized research zones into standard commercial industrial parks.

United Kingdom – The “Regulatory Sandbox”

The UK has positioned itself as a global leader by pursuing a radical reset of its regulatory landscape. By treating fusion as a "non-nuclear hazard" (distinct from fission), the UK is successfully attracting private developers seeking rapid deployment timelines.

Key 2025 Takeaway: Regulatory innovation is now a competitive advantage, as the UK actively recruits international startups by offering the world’s fastest "bench-to-grid" licensing path.

China – The “State-Led Backbone”

China’s BEST project in Hefei represents the world’s most advanced standardized manufacturing effort. Through China Fusion Energy Co. (CFEC), capitalized at $2.1 billion (€1.9B), China is executing a top-down industrial strategy that integrates state-owned entities with a market-oriented private ecosystem.

Key 2025 Takeaway: China is leading in the "industrialization of the supply chain," outpacing the West in the mass production of specialized reactor components.

Japan – The “Vertical Integrator”

Japan has solidified its role as a global "machine shop." In late 2025, the government designated fusion a "National Strategic Technology" with a $2.6B (¥400B) budget. Key milestones include the FAST project’s Conceptual Design completion and the nation’s first fusion PPA between Helical Fusion and Aoki Super, marking a shift toward retail-industrial adoption.

Key 2025 Takeaway: Japan’s vertical integration strategy strengthens its global manufacturing leadership while enabling early commercial adoption via strategic PPAs.

European Union – The “Consortium Model”

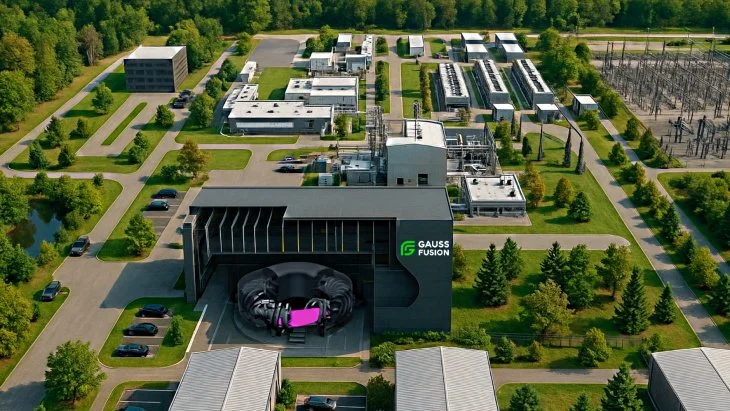

Gauss Fusion’s GIGA Conceptual Design Report (October 2025) pools industrial giants from Germany, France, Italy, and Spain. It targets continental energy sovereignty with a $16–$20B (€15–€18B) roadmap for a 1GW stellarator-based power plant.

Key 2025 Takeaway: Europe’s “Eurofighter for Fusion” strategy has created a unified industrial ecosystem, successfully identifying 900 potential sites across the continent for the first generation of commercial plants.

GIGA (Image: Gauss Fusion)

Atoms for Algorithms: The AI x Fusion Convergence

At the recent IAEA World Fusion Energy Group summit, a new paradigm emerged: “Atoms for Algorithms.” This structural alliance recognizes that AI is the primary tool for solving fusion’s physics challenges, while fusion addresses AI’s long-term, 24/7 energy demand.

Predictive Plasma Control: The partnership between Google DeepMind and Commonwealth Fusion Systems (CFS) integrated the TORAX simulator. This AI “pilot” sculpts plasma in real-time, effectively solving the 70-year challenge of plasma instability.

The Digital Twin Revolution: AI digital twins allow developers to test millions of operating scenarios in seconds. This has compressed development timelines that once took decades into mere months.

Strategic Takeaway: Fusion is no longer just a climate play; it has become a "compute play." The co-location of fusion reactors with AI data centers is the dominant infrastructure trend of late 2025.

Regulatory De-Risking: The “Green Light”

Institutional capital requires regulatory certainty. 2025 delivered a paradigm shift by officially decoupling fusion from safety protocols designed for nuclear fission.

The US ADVANCE Act: Finalized in late 2025, this act categorizes fusion machines as “particle accelerators” under a performance-based framework, significantly lowering administrative burdens and insurance premiums.

Global Safety Consensus: The IAEA reached a consensus that because fusion has zero risk of meltdown, it justifies a bespoke regulatory path.

Strategic Takeaway: This regulatory "unbundling" has turned fusion from a speculative venture into a bankable infrastructure asset for pension and sovereign wealth funds.

Market Performance Metrics

The F4E Fusion Observatory (December 2025 update) confirms an unprecedented acceleration of capital. The market has moved from speculative research to active implementation.

Total Global Funding: Cumulative investment reached $15.2 billion (€13B).

Capital Velocity: The sector experienced a 30% surge in capital inflow between June and September 2025 alone.

The “Unicorn” Era: Four companies now exceed $1.1 billion (€1B) in individual valuation: CFS, TAE Technologies, CFEC, and NEO Fusion.

Public Market Integration: The $6 billion merger between TAE Technologies and TMTG marks fusion’s arrival on public equity markets, providing the liquidity needed for "First-of-a-Kind" (FOAK) power plant construction.

The Verdict: 2026 Outlook

We close 2025 with the industry moving from “is it possible?” to “how fast can we build it?” The primary bottleneck is no longer physics; it now lies in engineering, supply chain constraints, and the scarcity of Suitably Qualified and Experienced Personnel (SQEP).

Most Likely to Grid: Helion Energy, targeting 2028 via its standing PPA with Microsoft

Largest Industrial Blueprint: Gauss Fusion, with its comprehensive GIGA plant roadmap

Highest Technical Performance: CFS, leveraging SPARC milestones and AI-driven control to optimize commercial ARC reactors

Strategic Takeaway: Momentum from 2025 indicates the first grid-connected pilot plants will likely be operational by 2028–2030. Fusion has officially moved from R&D budgets to CAPEX plans, signaling a new era for energy and finance leaders.