Fusion’s Decisive Era: What We Need to Watch in Near-Term Opportunities

Fusion is entering a decisive era where science alone is no longer enough. What was once measured by experimental milestones is now judged by the ability to move from demonstration to commercial reality, with investors and strategic partners assessing deployment potential, financial risk, and readiness to supply the grid. For decades, progress was defined by laboratory breakthroughs, but today the metric has shifted toward economic and operational viability.

Fusion now has early customers, signed PPAs, and construction activity underway. Commonwealth Fusion Systems advanced the industrial assembly of its SPARC reactor in Massachusetts, while Helion Energy progressed site preparation for its PPA with Microsoft, targeting initial delivery in 2028. Japan’s first commercial fusion PPA further confirmed that end-user demand is no longer theoretical—it is active and shaping strategic planning.

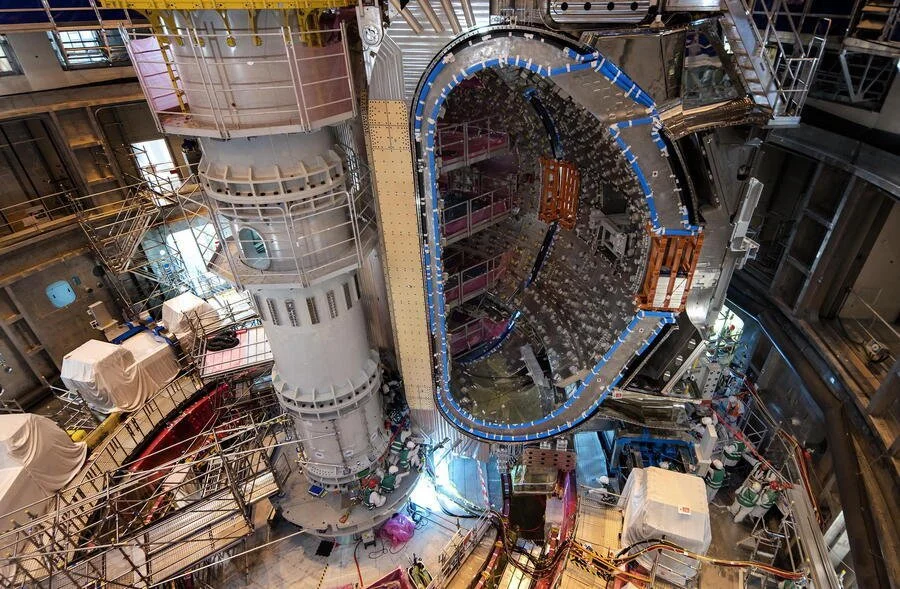

Assembly of the ITER tokamak — a landmark in large-scale fusion engineering, exemplifying global collaboration and the industrial groundwork driving the future of fusion energy. (Image: ITER Organization)

Engineering Viability on Risk and Readiness Evaluation

Physics risk is dramatically reduced; engineering is the frontier. Achieving scientific breakeven (Q > 1) is a milestone, but the true commercial gate is economic breakeven (Q(Economic) > 1)—building a durable, affordable, manufacturable power plant.

Industry efforts are now concentrated on de-risking the engineering barriers that directly determine deployment timelines and cost curves:

Industrialization & Assembly

CFS’s rapid assembly methodologies demonstrate that fusion machines can transition from bespoke prototypes to factory-built systems—an essential condition for scaling.

Core Plasma Stability

Advancements across global tokamak and non-tokamak programs—including the adoption of AI-driven control systems—show meaningful progress toward stable, high-temperature operation suitable for commercial duty cycles.

The Remaining Gating Factors

Two challenges now define the deployment timeline:

Materials Durability: Reactor components must withstand intense neutron flux for years.

Tritium Self-Sufficiency: Closing the fuel cycle remains essential for economic and operational scalability.

Strategic partnerships across the UK, Europe, and the private sector indicate active movement to address these constraints, but they remain the decisive barriers that separate demonstration from market deployment.

Private Demonstration vs. Public Deployment Reality (Financing)

Fusion is now a capital competition, and the division of responsibility is clear:

Private capital can take fusion to demonstration.

Only public-private partnerships can take fusion to deployment.

Billions flowed into fusion throughout 2025, funding the high-risk, high-iteration demonstration stage. But the cost of building, licensing, and certifying first-of-a-kind commercial plants exceeds what private markets alone can shoulder. This pressure has driven a coordinated industry push for federal and multilateral funding in the US and beyond.

Between June and September 2025, private fusion investment surged 30%, reaching $15.1 billion USD, according to the F4E Fusion Observatory. The data also highlights a stark contrast in global funding models:

US funding is dominated by private, high-risk capital, accounting for 94.5% of total investment.

China’s fusion industry is primarily state backed, representing 71.2% of its total funding.

Public-private partnerships are not subsidies—they are the strategic mechanism required to cross the “valley of death” between Q > 1 demonstration projects and fully deployable Q (Economic) > 1 commercial plants.

The Investor Window Is Taking Shape

Fusion has shifted from experimental uncertainty to engineering execution and capital strategy. With early PPAs signed and construction underway, the remaining determinants of leadership now lie in materials readiness, fuel-cycle closure, and the structure of public-private financing. If these barriers are successfully managed, a mid-2030s deployment trajectory remains credible.

For investors and strategic partners, the most compelling value will accrue to those who position early—before supply chains consolidate, regulatory frameworks mature, and public-private mechanisms lock in. Fusion’s trajectory is accelerating, and the earliest entrants stand to capture the most durable long-term advantage as the technology advances toward grid integration.