How California Is Building the World’s First Fusion Economy

In the race toward fusion commercialization, California isn't just past participating, they’re leading. Long celebrated as the birthplace of world-changing industries from Silicon Valley to the clean energy boom, the state is now positioning fusion energy as a strategic industrial force.

With Senate Bill 100, California committed to 100% clean, zero-carbon electricity by 2045 and to achieve that they mandated a demand for breakthrough solutions. A new report from the San Diego Regional EDC estimates if California captures the fusion opportunity, it could generate $125 billion in economic output and support tens of thousands of jobs across the state. What was once a physics experiment is swiftly becoming a job strategy, an investment magnet, and a manufacturing engine.

So, what does fusion truly mean for California’s future?

California’s Fusion Ecosystem: From Labs to Launchpads

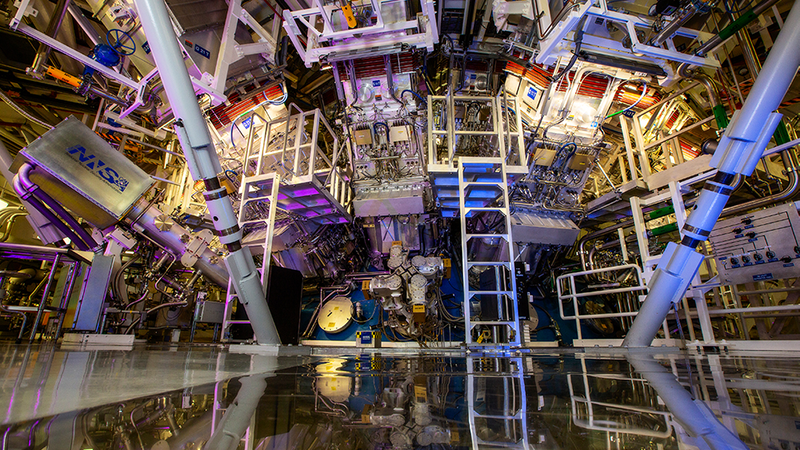

California is already the largest fusion hub in the United States, home to more than 16 fusion companies, including titans like General Atomics and TAE Technologies. These are reinforced by world-class research institutions like Lawrence Livermore National Laboratory (LLNL) and the San Diego Fusion Cluster, making the state uniquely equipped to move from R&D to commercialization.

Venture capital has followed. Since 2021, California fusion startups have raised more than $2.2 billion, making it the top U.S. destination for fusion investment. The state is not just participating in this emerging industry, it is shaping it. Momentum accelerated in 2024 with the passage of SB 80 — the Fusion Energy Development Act. The bill directs state agencies to streamline permitting, support grid interconnection, and officially classify fusion as a clean energy source. As Senator Anna Caballero stated: “Fusion is not science fiction — it’s an industrial opportunity.”

Another breakthrough for California in 2025, General Atomics and UC San Diego launched a Fusion Data Science & Digital Engineering Center, combining fusion, AI, and data science to accelerate reactor design and workforce development.

Workforce Acceleration: Training the Fusion Generation

Today, fusion activity already supports approximately 4,700 jobs across California and generates $1.4 billion in annual economic output. But industry forecasts suggest that once commercialization begins, fusion could support more than 40,000 high-paying jobs statewide.

In April 2025, UC San Diego secured a new agreement with the DIII-D National Fusion Facility, allowing its graduate students to access the tokamak even without long-term grants. This access provides hands-on experience, networking, and growth opportunities for the state’s next cohort of fusion engineers. According to the UC San Diego Fusion Engineering Institute, the demand for a skilled fusion workforce is accelerating, and the institute is intentional about closing that gap.

Private Capital Meets Public Will

One of the clearest signs fusion is no longer science fiction is the shift from government grants to deep tech venture funding. Globally, fusion startups have raised nearly $10 billion, a five-fold increase since 2021. Major California players like TAE Technologies continue to secure massive rounds, attracting investment from heavy-hitters including Google and Chevron. The nature of these investments indicates a conviction: fusion is a near-term industrial revolution, not a distant promise.

The fusion ecosystem in California is diverse and that became the magnet for capital. Seeing all the industry there –the academic institutions, research labs, regulatory framework, and skilled talent– convince the investor to pour their funding. Being an investor in new technologies, they don’t only see the technology, but the state baked-in to scale, pilot, and commercialize.

Sustaining the Traction: California’s Fusion Future

While California leads in research and private capital, maintaining momentum requires overcoming significant commercialization hurdles. The primary challenge is the leap from successful R&D to full-scale deployment. To address this, strategic actions are focused on three key areas:

Regulatory Certainty: Fully implementing the recognition of fusion as a clean energy source and creating clear, streamlined regulatory pathways that separate fusion from the highly restrictive framework of nuclear fission.

Infrastructure and Siting: California must prepare shovel-ready industrial sites with grid capacity and favorable land use. Permitting delays and grid interconnection bottlenecks are among the most cited hurdles for the establishment of commercial pilot plants.

Incentives & Legislative Momentum: Beyond Senate Bill 80’s $5 million initial commitment, legislative efforts like SCR 25 set a state goal of siting the first-of-a-kind fusion pilot plant in California by the 2040s. Furthermore, new legislation aims to expand state green energy tax incentives to explicitly include fusion projects, ensuring the state remains competitive against other nations and states vying to host the world's first commercial fusion device.

Fusion as an Industrial Strategy

For California, fusion has transcended its role as a climate fix. It is now a central pillar of state industrial policy. Under the California Jobs First Economic Blueprint, fusion and quantum technologies are codified as priority sectors, placed alongside semiconductors, aerospace, and AI. That’s not symbolic, it means these sectors receive strategic attention, resources, and state support.

By directing an initial $5 million via Senate Bill 80 into the Fusion Research & Development Innovation Initiative, California is invoking a classic playbook: early state investment to catalyze private scale. Much like solar, biotech, or semiconductors before it, fusion is being baked into the DNA of the state’s future economy.

That strategy serves two critical goals:

It bolsters energy security, delivering a zero-carbon, baseload solution aligned with the 2045 clean energy goal.

It creates a high-value export industry, enabling California to produce fusion systems, components, and intellectual property — not just consume them.

The stakes are clear: whoever commercializes fusion first will command tomorrow’s energy economy, and California is strategically positioning to do just that.