How Manufacturing, Capital, and Policy Are Converging to Accelerate Fusion

Fusion energy is no longer an abstract scientific pursuit. It is entering a decisive industrial phase—where manufacturing capacity, capital formation, and policy clarity are emerging as the three forces that will determine how quickly fusion becomes a commercial reality. The sector has moved far beyond physics validation. With private developers accelerating timelines, global regulatory frameworks taking shape, and engineering supply chains preparing for scale, the question is shifting from if fusion will work to how fast the world can build it. As the industry positions itself for grid-connected fusion electricity in the 2030s, its success now hinges on a coordinated convergence of industrial capability, investment strength, and supportive policy environments.

The Commercial Pivot: From Scientific Milestone to Market Acceleration

Private capital is reshaping the fusion landscape at unprecedented speed. Total investment in surveyed fusion companies has reached $9.766 billion—a five-fold surge since 2021. The last 12 months alone saw $2.64 billion raised, an increase of 178% year-on-year.

This influx of capital signals a new strategic priority among fusion developers:

Transitioning from physics R&D to commercialization

Shifting focus from breakeven metrics to cost competitiveness

Preparing to secure large-scale project financing

Building the first generation of deployable fusion plants

For decades, plasma breakeven (Q>1) defined progress. While still important, the private sector is now aligned around a commercial metric: Levelized Cost of Electricity (LCOE). Fusion’s extraordinary energy density makes this path compelling—a single kilogram of fuel contains the energy of 13,000 tons of coal—but cost-effective deployment will require industrial-grade execution.

Digital Acceleration: AI, HPC, and the Rise of Fusion Digital Twins

Digital technologies are rapidly de-risking fusion development. AI-driven plasma control, high-performance computing (HPC), and emerging digital twins are enabling teams to simulate, predict, and optimize designs at a pace traditional experimental cycles cannot match. A defining milestone occurred in March 2025, when Japan’s QST and NTT unveiled an AI-based plasma prediction method—an important breakthrough in stabilizing one of fusion’s most challenging physics problems.

These tools will be essential for the next phase of deployment. Digital twins, in particular, will help developers:

Test engineering decisions before fabrication

Predict component lifetimes

Identify failure modes early

Reduce cost and development risk

As fusion plants transition from concepts to engineered products, digital acceleration becomes a critical competitive differentiator.

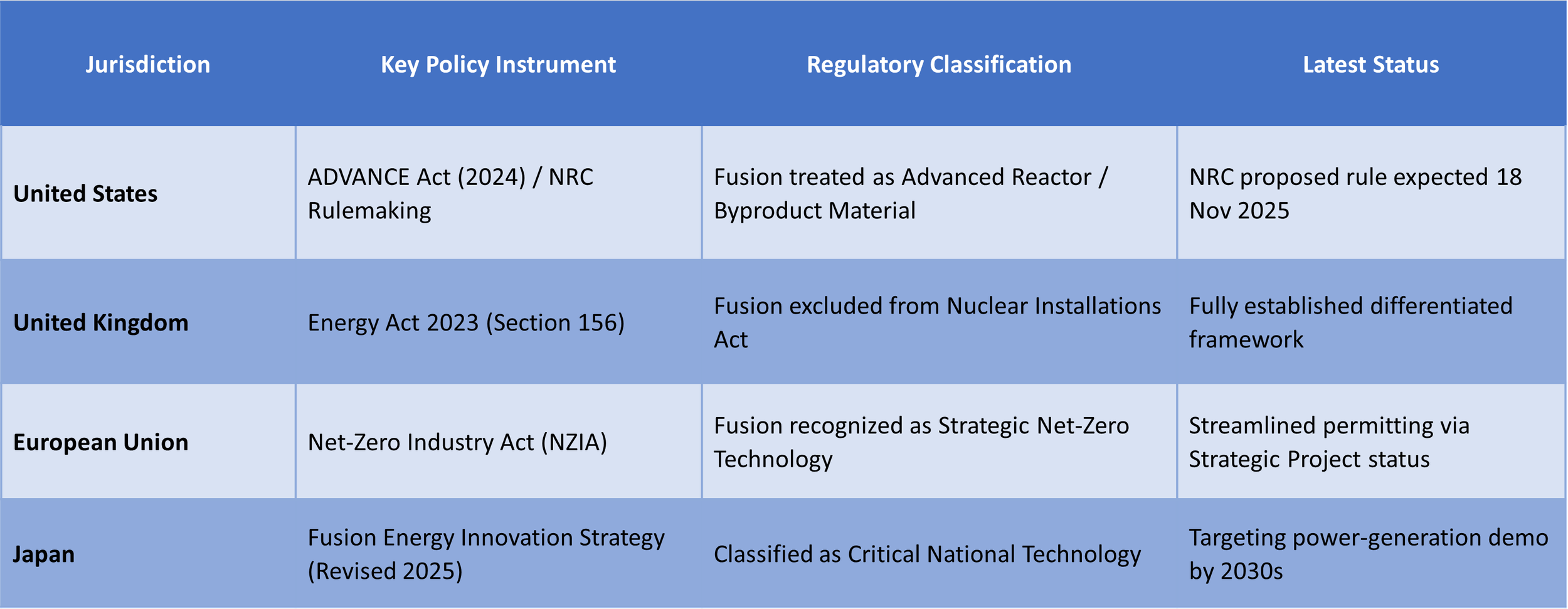

Policy Alignment: Regulatory Clarity as a Growth Catalyst

Governments worldwide are acting decisively to provide regulatory certainty and explicitly differentiate fusion from nuclear fission. This clarity is a major driver of private investment and industrial planning.

The UK Energy Act 2023 explicitly excludes fusion energy facilities from requiring a nuclear site license, offering maximal flexibility and speed. Conversely, the U.S. NRC’s effort under the ADVANCE Act aims to streamline the process by establishing efficient, predictable license application reviews for fusion machines. This regulatory divergence is expected to influence where initial deployment projects will be located.

Engineering Reality: Where Fusion’s Industrial Bottlenecks Are Emerging

With scientific validation largely secured, the next phase of fusion will be defined by engineering and manufacturing readiness. Three industrial bottlenecks stand out:

A. HTS Magnet Manufacturing: The First Major Scale Challenge

High-temperature superconducting (HTS) magnets are the backbone of modern compact fusion systems. The 2021 demonstration of a 20 Tesla magnet by CFS and MIT proved the physics—but exposed a new constraint: production capacity.

Key realities:

HTS magnets make up 30–60% of reactor core capital cost

REBCO tape supply is extremely limited

Fujikura’s 2025 line produces only 1,200 km/year, far below global demand

Most HTS supply is concentrated in Asia-Pacific, posing strategic vulnerabilities

Developing diversified, large-scale HTS manufacturing represents one of the biggest industrial opportunities—and risks—facing the sector.

B. Fuel Cycle Engineering: Achieving Tritium Self-Sufficiency

Commercial fusion plants must generate their own fuel. The numbers make this unavoidable:

Global civilian tritium inventory: ~30 kg

Annual tritium needs of a 1 GWe plant: ~55 kg

To operate continuously, reactors must achieve a Tritium Breeding Ratio (TBR) above 1. This requires:

Advanced breeding blanket systems

High-performance materials like PbLi alloys

Strong QA/QC manufacturing standards

Expertise drawn from the nuclear fission supply chain

Without TBR > 1, reactors cannot stay online—making tritium self-sufficiency a defining engineering milestone for fusion commercialization.

C. Materials Qualification: The 14 MeV Neutron Barrier

Fusion’s high-energy neutron environment is among the harshest of any engineered system. Components must withstand 14.1 MeV neutron flux for years—yet the world lacks a dedicated facility to test materials under such conditions.

The planned IFMIF/EVEDA project aims to close this gap. Until then, developers face a “licensing paradox”:

Regulatory pathways are accelerating

But key materials data needed for final approval cannot yet be produced at scale

This is one of the few bottlenecks requiring significant public-sector investment to unlock the final stage of fusion deployment.

Fusion’s Industrial Era Begins Now

As fusion enters its most pivotal decade, three forces—manufacturing, capital, and policy—are aligning to accelerate commercialization:

Manufacturers gain new pathways into high-integrity components, superconducting systems, materials engineering, and advanced fabrication.

Investors see a sector rapidly de-risking, supported by clear policy signals and maturing private developers.

Industry leaders and policymakers can position national supply chains for one of the most consequential technologies of the 21st century.

The science is ready.

The digital tools are emerging.

The capital is flowing.

The policy frameworks are in place.

What happens next depends on how quickly the world’s industrial base can build the components, materials, and systems that will define fusion power plants of the future.