Inside TAE’s 2025 Plasma Breakthrough—and How It Changed Fusion’s Trajectory

The first half of 2025 marked a significant pivot in the global fusion energy landscape. The shift from laboratory research to commercial readiness is no longer hypothetical — it's happening. At the heart of this transformation is TAE Technologies, a private-sector leader whose breakthroughs are redefining how business, policy, and clean energy intersect. This review outlines the major developments across public and private fusion sectors in H1 2025 and highlights emerging opportunities and trajectories as the sector enters its next phase.

TAE Technologies: Leading Fusion's Commercial Charge

In April 2025, TAE Technologies announced a major technical milestone with its "Norm" experimental device, which demonstrated stable plasma at temperatures over 70 million °C using only neutral beam injection (NBI). This approach — published in Nature Communications — bypasses complex traditional startup systems, drastically simplifying reactor design.

Why does this matter? Because this simplification translates into reduced machine cost, smaller footprints, and faster paths to commercialization — aligning with the broader shift toward scalable, deployable energy solutions. TAE estimates up to a 50% reduction in reactor complexity, signaling fusion’s readiness to integrate with advanced manufacturing and clean energy ecosystems.

Strategically, this is more than a scientific milestone. TAE's collaboration with Google — leveraging AI tools to optimize plasma stability — has accelerated its progress and validated the company's approach. In June 2025, TAE raised over $150 million in a funding round led by Google and Chevron, bringing its total equity capital to over $1.3 billion. These backers reflect growing confidence in fusion’s emerging role within the clean energy mix.

Policy Tailwinds: Enabling Fusion's Market Entry

Governments worldwide are recognizing fusion as a long-term strategic asset. Key policy moves in H1 2025 include:

United States: Focus on preserving technology-neutral tax credits (48E, 45Y) and a proposed $4.95 billion investment in the DOE’s Milestone-Based Fusion Development Program.

United Kingdom: Announced £410 million in new funding for 2025–2026 to support STEP (Spherical Tokamak for Energy Production) and “Fusion Futures” initiatives.

European Union: Released its first "Call for Evidence" in June for a pan-EU Fusion Strategy, focusing on private sector acceleration and regulatory clarity.

These initiatives help reduce financial and regulatory risk for private firms, opening new avenues for technology development, procurement, and collaboration. Policy clarity has helped unlock the next phase of investment and supplier engagement.

Capital & Ecosystem Build: Fueling Fusion's Scale-Up

The fusion sector’s capital inflows continue to surge. By mid-2025, private fusion firms had raised over $9 billion cumulatively, with $7 billion entering the market in just the past few years. Unlike many clean technologies that saw dips in 2024, fusion investment has proven resilient.

Alongside capital, the fusion supply chain is gaining momentum. According to the Fusion Industry Association, supply chain spending rose 73% in 2024 to $434 million and is projected to grow another 25% in 2025. This creates near-term growth across:

Advanced materials: High-temperature superconductors (HTS), plasma-facing materials (PFMs)

Precision manufacturing: Components with tight tolerances for plasma environments

Diagnostics & control systems: Sensors, real-time plasma monitoring, and safety controls

Power electronics & AI: Advanced systems for power delivery and algorithmic stability control

With the sector actively transitioning into its hardware phase, the need for integration partners, solution providers, and qualified suppliers continues to grow.

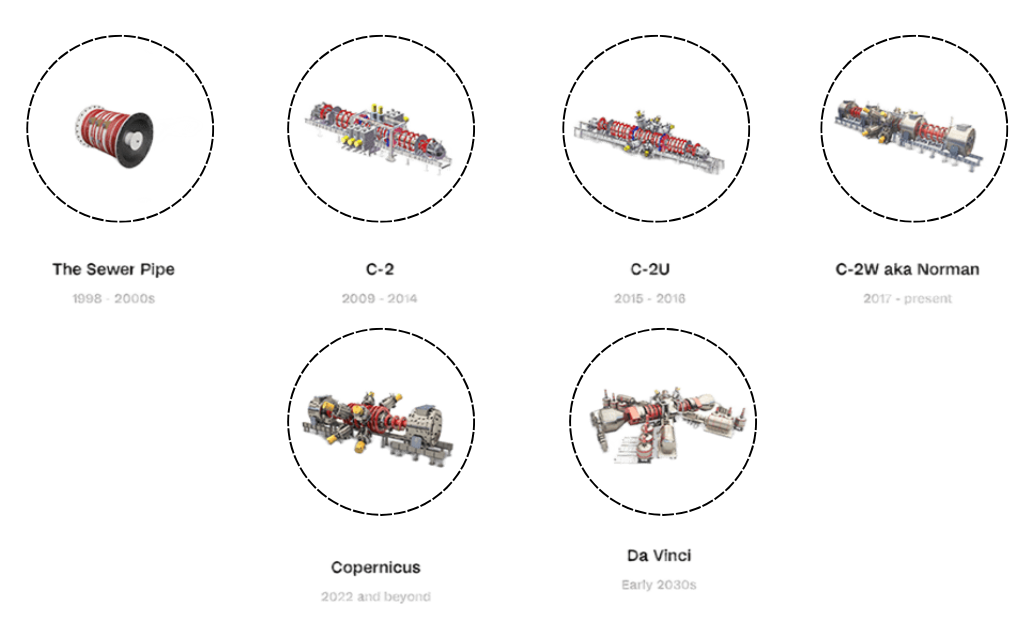

TAE Technologies' History of Innovation:

A, B, C-1 (1998–2000s) - Develop a compact linear fusion concept combining plasma and accelerator physics | Milestone: Achieved stable plasma core and fuel injector method

C-2 (2012) - Validate configuration in a full machine | Milestone: Proved plasma confinement

C-2U (2015) - Show sustained plasma for stability | Milestone: Plasma could be held indefinitely at will—first key step to fusion

C-2W / Norman (2019–2022) - Reach reactor-grade plasma temperatures | Milestone: Achieved stable plasma at 50M+°C (2019), now operating at 70M+°C (2022)

Copernicus (Expected ~2025–26) - Demonstrate net energy output | Milestone: In progress

Da Vinci (Expected Early 2030s) - First hydrogen-boron fusion plant delivering power to grid | Milestone: Future prototype

The Competitive Landscape: Diverse Paths to Commercialization

While TAE is a standout, other players are shaping the competitive landscape:

Helion Energy began construction of its Polaris facility, targeting first electricity by 2028. It’s backed by a significant agreement with Microsoft to purchase fusion power.

Commonwealth Fusion Systems (CFS) completed magnet subsystem testing for its SPARC reactor and remains on track for net energy validation by 2027.

Zap Energy continues tests on its compact Z-pinch device, FuZE-Q, with an eye toward scientific breakeven.

ITER achieved significant assembly progress in Q2 2025, with major components being integrated and a magnet cold test facility set for commissioning.

These developments signal increasing technological diversity — and healthy competition — in the race to bring fusion to market.

H2 2025 Outlook: Accelerating Towards Deployment

Looking ahead, TAE’s “Copernicus” reactor is expected to begin integrated testing, validating the NBI-driven plasma approach pioneered by Norm. Its first commercial prototype, “Da Vinci,” is slated for the early 2030s.

Meanwhile, governments and private actors are aligned on accelerating regulatory and construction frameworks. The U.S. DOE is expected to release a full fusion roadmap in Fall 2025, and the EU’s Fusion Strategy is scheduled for year-end publication.

Continued developments in the second half of the year are expected to emphasize:

Vendor qualification for pilot plant systems

Grid integration modeling and software

Cross-border regulatory harmonization

Digital twin and AI-integration pilots

Strategic Engagement: Capturing the Fusion Opportunity

The first half of 2025 confirms that fusion is no longer a 30-year horizon — it's a tangible, near-term opportunity with accelerating momentum. TAE Technologies' achievements are setting the tone, while others like Helion, CFS, and Zap continue to sharpen the commercial race.

The sector is transitioning from theoretical development to deployment readiness — and with it comes a new wave of collaborative potential. For those positioned in advanced technologies, manufacturing, software, or clean energy systems, fusion's trajectory presents both market and partnership opportunities. As capital continues to flow and policies mature, the industry is laying down its commercial foundation — and there's still time to help shape it.